wake county nc tax deed sales

Apply for a Marriage License Request Birth Marriage or Death Certificates Review Adoption and Legal Name change information Notary Public Oath and office policies. In North Carolina the tax collector or treasurer will sell tax deeds to the winning bidders at the delinquent property tax sales.

May 2022 S Median Price Of Wake County Real Estate Topped 462 000 Another New Record High Wake County Government

The 2018 United States Supreme Court decision in South Dakota v.

. Has impacted many state. Interest Rate andor Penalty Rate. For Additional sale information you can select the link below.

Ad HUD Homes USA Can Help You Find the Right Home. A tax lien attaches to real estate on January 1 and remains in place until all taxes on the property are paid in full. This tax is collected by the merchant in addition to NC.

Wake County Transit Sales and Use Tax. Ownership sale information and property detail for all Wake County real estate parcels is available for download. The median property tax.

The North Carolina state sales tax rate is currently. Lobby of Davie County Court House. This can be enforced by individuals.

The relevant North Carolina statute is GS. The sale vests in the purchaser all right title and interest of Wake County in the property including all delinquent taxes which have become a lien since issuance of North Carolina tax deed. The current total local sales tax rate in Wake County NC is 7250.

Ad Find Tax Foreclosures Under Market Value in North Carolina. Ad HUD Homes USA Can Help You Find the Right Home. North Carolina has a 475 sales tax and Wake County collects an.

North Carolina has a 475 statewide sales tax rate. Property Tax Collections Past Due Taxes Business Registration. The Henderson County Tax Collector is authorized to foreclose on real property for which delinquent property taxes remain unpaid.

Search All of the Most Up-to-Date Foreclosure Listings Available Near You. Wake Forest NC 27587. Everyone is happy Wake County North Carolina recovers lost tax revenue the purchaser acquires title to the tax delinquent property free and clear of.

View statistics parcel data and tax bill files. To view instructions on retrieving a full listing of real estate billing and delinquent files please visit our page for Real Estate Tax Bill Payment Files. The total sales tax rate in any given location can be broken down into state county city and special district rates.

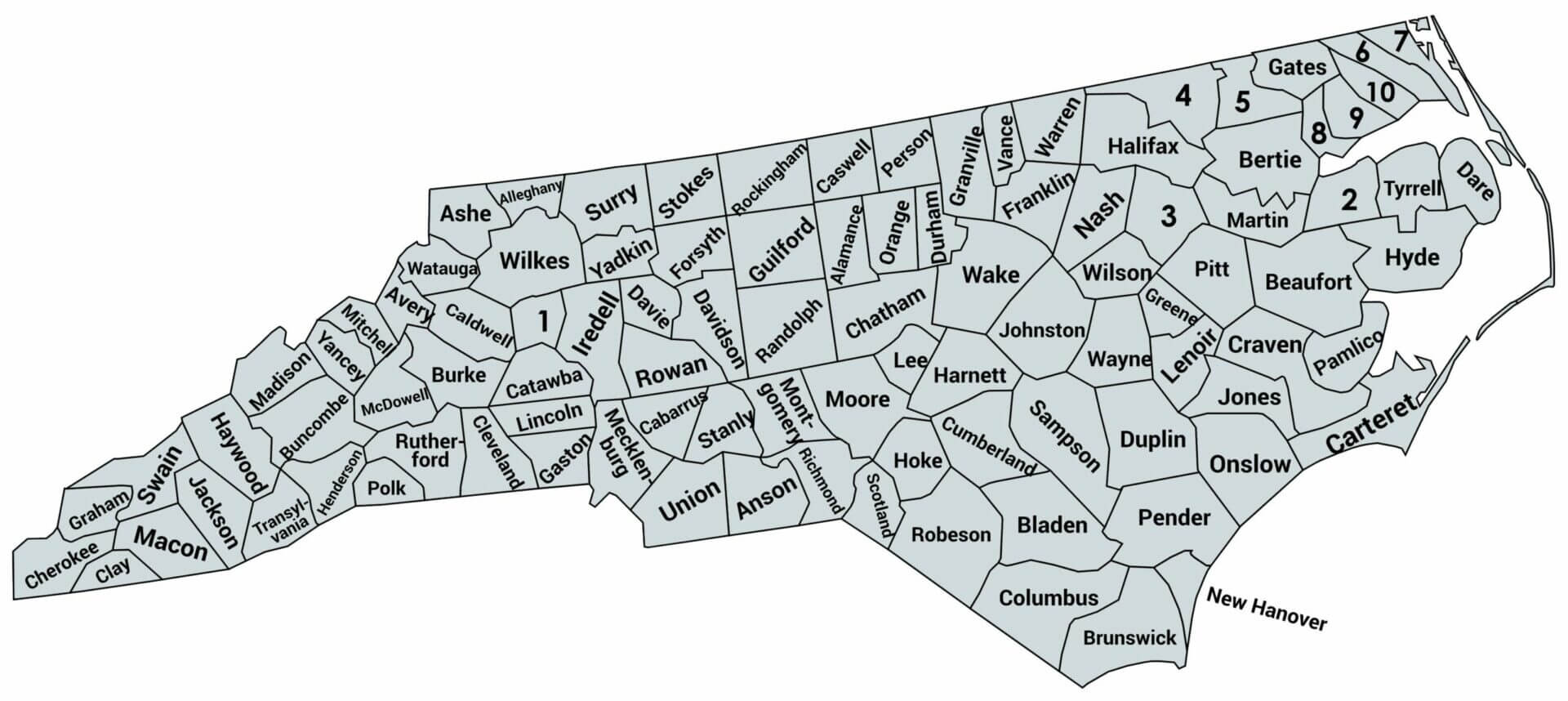

Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143 counties in order of median property taxes. Sales are conducted on the courthouse steps at 200 North Grove St Hendersonville NC 28792. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

75-1 the Unfair Trade Practice Act UTPA. Individual income tax refund inquiries. Wake County collects on average 081 of a propertys assessed fair market value as property tax.

Pay tax bills online file business listings and gross receipts sales. The December 2020 total local sales tax rate was also 7250. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes.

The Wake County Sales Tax is collected by the merchant on all qualifying. You can sort by county by clicking the drop down menu under the County Category and. Property Tax Collections Collections.

Register for Instant Access to Our Database of Nationwide Foreclosure Listings. Search real estate and property tax bills. North Carolina Department of Revenue.

The Wake County sales tax rate is. Map More Homes in Wake Forest. According to state law the sale of North Carolina.

Generally the minimum bid at an Wake County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. PO Box 25000 Raleigh NC 27640-0640. The properties listed for sale are subject to change without notice.

This action is required by North Carolina General Statutes. The Wake County Register of Deeds office has deeds survey plat and highway maps nuptial agreements restrictive covenants and other documents recorded at this office. Learn about listing and appraisal methods appeals and tax relief.

The full Wake County real estate file is available in the following formats. State Sales Tax and is remitted to the County on a monthly basis. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

Premium bid highest bid. Prepared Food and Beverages This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that are subject to sales tax imposed by the State under GS. Find your North Carolina combined state and local tax rate.

The minimum combined 2022 sales tax rate for Wake County North Carolina is. In North Carolina the County Tax Collector will sell Tax Deeds to winning bidders at the Wake County Tax Deeds sale. The data files are refreshed daily and reflect property values as of the most recent countywide reappraisal.

To see a list of upcoming tax foreclosure sales please visit the websites of the law firms conducting the sales. Commencement of any of these actions will result in additional costs andor fees being added to the unpaid bills. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300.

Real estate in Wake County is permanently listed and does not require an annual listing. This is the total of state and county sales tax rates. This table shows the total sales tax.

This rate includes any state county city and local sales taxes.

10328 Ten Ten Rd Raleigh Nc 27603 9029 Mls 2422103 Redfin

June 2022 S Median Price Of Wake County Real Estate Reached 470 000 Setting A New Record High Wake County Government

Imaps Information Wake County Government

June 2022 S Median Price Of Wake County Real Estate Reached 470 000 Setting A New Record High Wake County Government

Complete List Of Tax Deed States

Spring Has Sprung At The Allen House Volunteers Needed On Saturday The Old House Life

Imaps Information Wake County Government

Wake County Nc House Auctions Realtytrac

Nc Residents Needing Birth Certificates Marriage Licenses Quickly Flood Johnston Office Wral Com

Allen House Update The Old House Life

May 2022 S Median Price Of Wake County Real Estate Topped 462 000 Another New Record High Wake County Government

9004 Patmos Way Wake Forest Nc 27587 Mls 2457226 Redfin

May 2022 S Median Price Of Wake County Real Estate Topped 462 000 Another New Record High Wake County Government

Wake County Nc Black Wide Awake

Wake County Deed Of Trust Form North Carolina Deeds Com

Wake County Nc Black Wide Awake

June 2022 S Median Price Of Wake County Real Estate Reached 470 000 Setting A New Record High Wake County Government